Table of Content

As the most tenured and experienced behavioral staffing agency in the country, SHC offers a wide array of community-based services designed to support nurses, behavioral health techs, social workers, and more. The Consulate is also a major regional conference and training center for staff from other embassies and consulates, and it provides consular-services support functions for the region. It takes a special type of clinician to deliver care that goes the distance, whether easing patients into an office visit today or extending a helping hand tomorrow.

Many of the treatments used today would not be available if they were not first tested in clinical trials. If you’re looking to make an impact for lives in need, positions in the Veterans Administration, Department of Corrections or for small service-oriented businesses can be surprisingly rewarding. Supplemental Health Care connects skilled home health professionals to rewarding opportunities across the country—resulting in more than 1,400 completed assignments in the last two years. For the 13th year, Stanford Health Care has been named to the Digital Health Most Wired list for ambulatory and acute care, a top honor in digital health care leadership. A team of doctors and machine learning experts at Stanford Medicine developed a database of diverse skin tones used to train algorithms in detecting diseases in patients with a darker complexion.

You are unable to access npiprofile.com

Access your health information from any device with MyHealth. You can message your clinic, view lab results, schedule an appointment, and pay your bill. As the preferred staffing partner for districts and educational facilities across the country, SHC’s Schools division places school nurses, speech professionals, school psychologists, special education teachers, and more.

Ongoing support and resources keep you up-to-date while connecting you with a supportive network of home care professionals. Outcome and Assessment Information Set training checks the box for the skills and certification you’ll require to get placed and excel in home care. SHC’s Homecare Homebase training is designed by industry experts to give you the head start and support you need right from the beginning. Over 30+ Home Health recruiters and managers are experts and leaders in patient care delivered in personal settings. This website is using a security service to protect itself from online attacks. The action you just performed triggered the security solution.

Correctional Health & Government Services

If you’re looking to broaden your reach for compassionate care, in positions like nursing and therapy, SHC is your willing partner. With access to Oasis and Homecare Homebase training, SHC supports you with far more than a job lead today. We’re here to help support your home health career development.

We support dozens of skill sets, partnering with professionals specializing in radiology, respiratory care, lab staffing, physical therapy, occupational therapy, speech-language pathology, and related disciplines. Once your doctor refers you for home health services, the home health agency will schedule an appointment and come to your home to talk to you about your needs and ask you some questions about your health. The home health agency staff will also talk to your doctor about your care and keep your doctor updated about your progress.

Stanford Medicine Second Opinion Program

There are several actions that could trigger this block including submitting a certain word or phrase, a SQL command or malformed data. The Stanford Healthcare Innovations Lab held a summit to address new approaches to mental illness treatment, from psychedelics to imaging tools. From registered nurses to LPNs and CNAs, we’re here to fuel your personal growth and liberate your career.

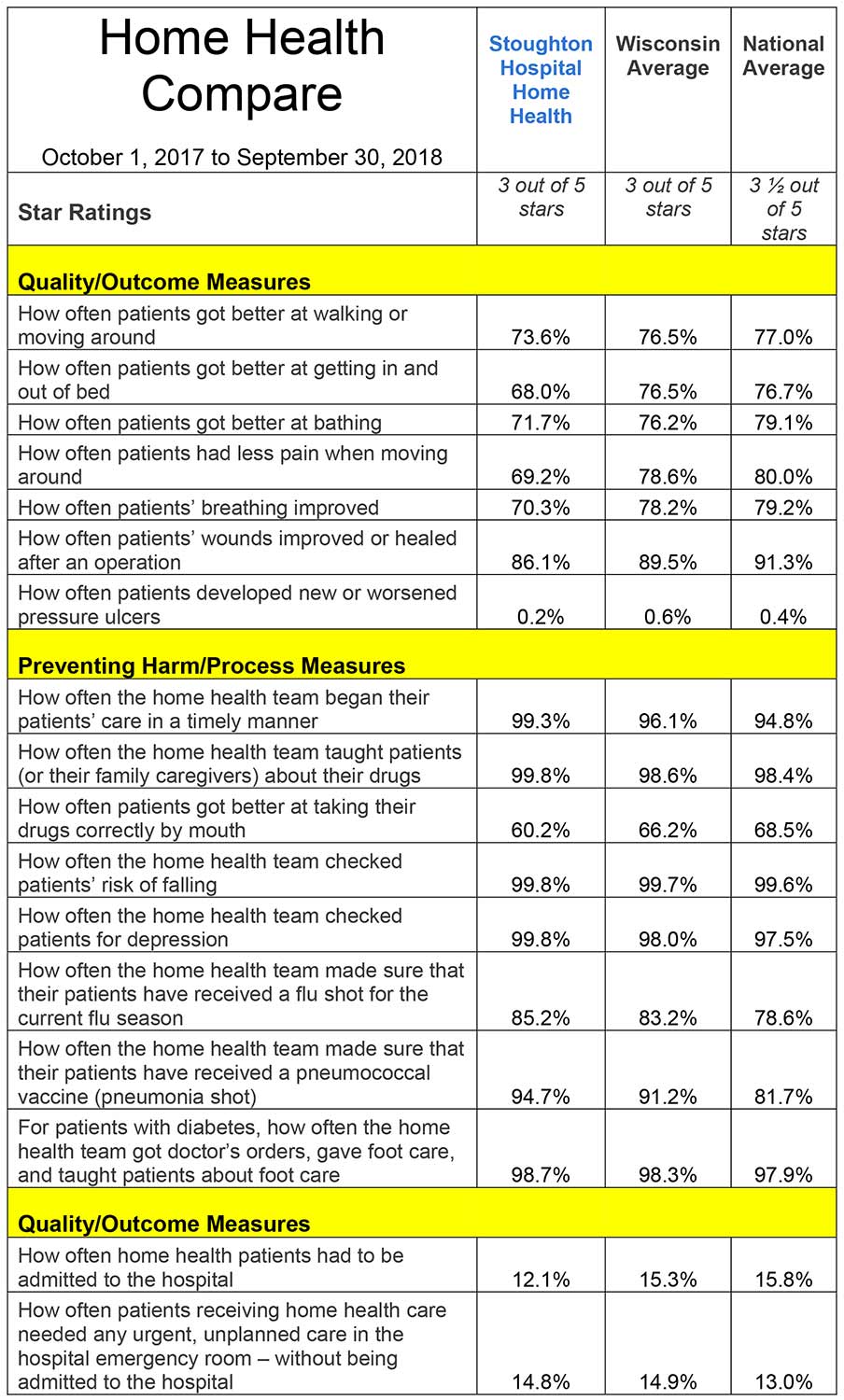

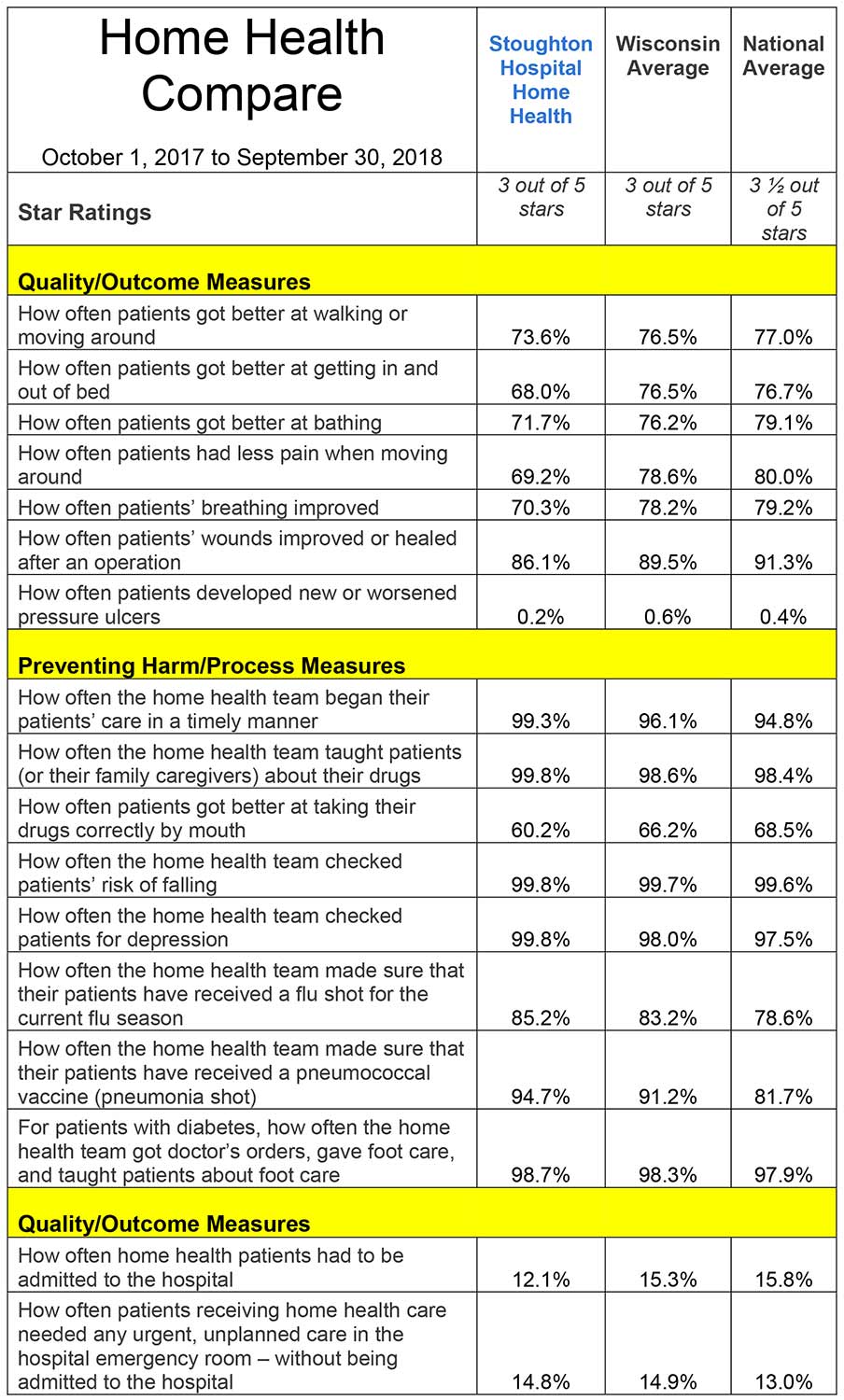

It’s important that home health staff see you as often as the doctor ordered. The quality ratings gives you an indication of the care Signature Homenow give to their patients incomparison to other home health agencies. This quality rating is based on process quality measures and patient outcome measures survey conducted by CMS.

Registered Agent is CORPORATION SERVICE COMPANY

While home health patients can be among the most vulnerable, support from our dedicated recruiters and access to OASIS and Homecare Homebase training helps set you up for success as a home health nurse or professional. The goal of home health care is to treat an illness or injury. Home health care helps you get better, regain your independence, and become as self-sufficient as possible.

Our Home Health division connects the right nurses, therapists and home health aides with the right families and communities that need a specific level of care. The SHC team recognizes the profound impact that home health professionals can have on their patients’ quality of life. That’s why we’re proud to have a dedicated Home Health & Hospice Division, featuring the expertise of professionals focused 100% on Home Health. Clinical trials are critical to progressing medical advancements and helping people live longer.

A .gov website belongs to an official government organization in the United States. Once you have finished selecting the documents to upload, click on the Save button to transmit your document to your medical record. The rewards of home health are many, but the demands of caring in personalized settings are unique. SHC offers a range of helpful tools and pathways to knowledge here.

Becoming a patient at Stanford Health Care is easy, no matter where you live or work.

Whether you’re navigating licensure, housing or benefits, with SHC, a caring heart can make an impact—here, there, anywhere. With a passionate belief in the power of caring, Supplemental Health Care (“SHC”) connects nursing professionals like you with employers seeking the best talent possible. Find your next opportunity across our continuum of care.